Maximize your benefits and unlock bonus credits with the Federal ITC for your commercial solar investment

For any commercial or industrial property owner considering investing in a solar project, it’s essential to know that there are federal solar tax credits for businesses to make commercial solar systems cost-effective.

Two tax incentives are essential policy mechanisms supporting the growth of solar energy in the United States.

- The investment tax credit (ITC) is based on the percentage of the installation cost of the commercial solar system.

- The production tax credit (PTC) is calculated by the amount of electricity the commercial solar system produces over time.

ITC vs. PTC

Both tax credits are excellent commercial solar incentives but have different applications and cannot be used together on a solar project.

The ITC is an upfront incentive that reduces federal income tax liability by 30% of a solar system’s total installation cost, leading to enormous savings for project owners. In 2022, the Inflation Reduction Act (IRA) set the percentage rate at 30%, which will remain the same for any solar project that begins construction before 2033.

The PTC is a per kilowatt-hour (kWh) incentive. Project owners will receive a base credit of 2.75¢ per kWh of energy produced by the solar system in its first 10 years of service. Like the ITC, a solar system must have its construction started before 2033 to qualify for this tax incentive.

WHICH TAX CREDIT IS BEST FOR MY BUSINESS?

Choosing which incentive to use is primarily based on the size of the solar project and how much sunlight the panels receive.

Because the PTC is based on system performance, it makes it ideal for large-scale, utility-sized commercial projects.

However, not all commercial projects produce enough power for a PTC to make sense. In these instances, the ITC is better suited.

Since the incentive is an upfront tax credit, it significantly reduces installation costs, greatly benefiting project owners.

10% BONUS CREDITS

In addition to the ITC and PTC, a project owner’s commercial solar system could qualify for even more incentives based on various factors. The best part about these tax adders is they can stack on top of the base credit.

ENERGY COMMUNITY BONUS

Commercial solar projects in certain areas can qualify for the Energy Community Bonus. If the solar project meets these requirements, it is eligible for a bonus adder of 10% for the ITC or 0.3¢/kWh for the PTC.

These communities include brownfield sites, statistical areas with historically high fossil fuel industry activity, and census tracts (and adjoining tracts) with closed coal mines or coal-fired power plants.

Southern California counties such as Los Angeles, Orange, Ventura, and Kern qualify for 40% ITC.DOMESTIC CONTENT BONUS

Projects that meet the minimum requirements for the Domestic Content Bonus can receive an additional 10% for the ITC or 0.3¢/kWh for the PTC.

To qualify, all structural steel or iron products must be produced in the U.S. Additionally, a required percentage of the products and components of the facility need to be mined, produced, and manufactured in the States.LOW-INCOME BONUS

Commercial solar projects using the ITC could earn even more tax adders from the Low-Income Bonus.

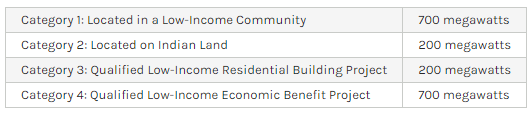

For the low-income bonus, a solar project must have a maximum net output of 5MW and fall in one of the four categories below. Projects are also subject to a 1.8GW program cap per year.

A 10% bonus credit is eligible for solar projects installed in low-income communities or on Indian land. Projects from a qualified residential building or low-income economic benefit project could receive a 20% bonus credit.

The federal government has established policies to make solar systems more affordable for businesses and nonprofit organizations.

These policies can seem confusing, so choosing the right solar installer is an important decision in the buying process.

At Green Convergence, our financial expertise will navigate these federal incentives to drive down costs for commercial and industrial solar projects while saving the most money possible.

Contact commercial@greenconvergence.com to see how much you can save on your solar investment.