Earn an additional 10% or 20% tax adder on the Federal ITC

The implementation of the Inflation Reduction Act (IRA) has significantly improved the economic landscape for solar and energy storage projects.

The IRA focuses on federal tax incentives, particularly the Federal Investment Tax Credit (ITC), which has paved the way for substantial cost reductions in project installations, especially in low-income communities.

The Federal Investment Tax Credit

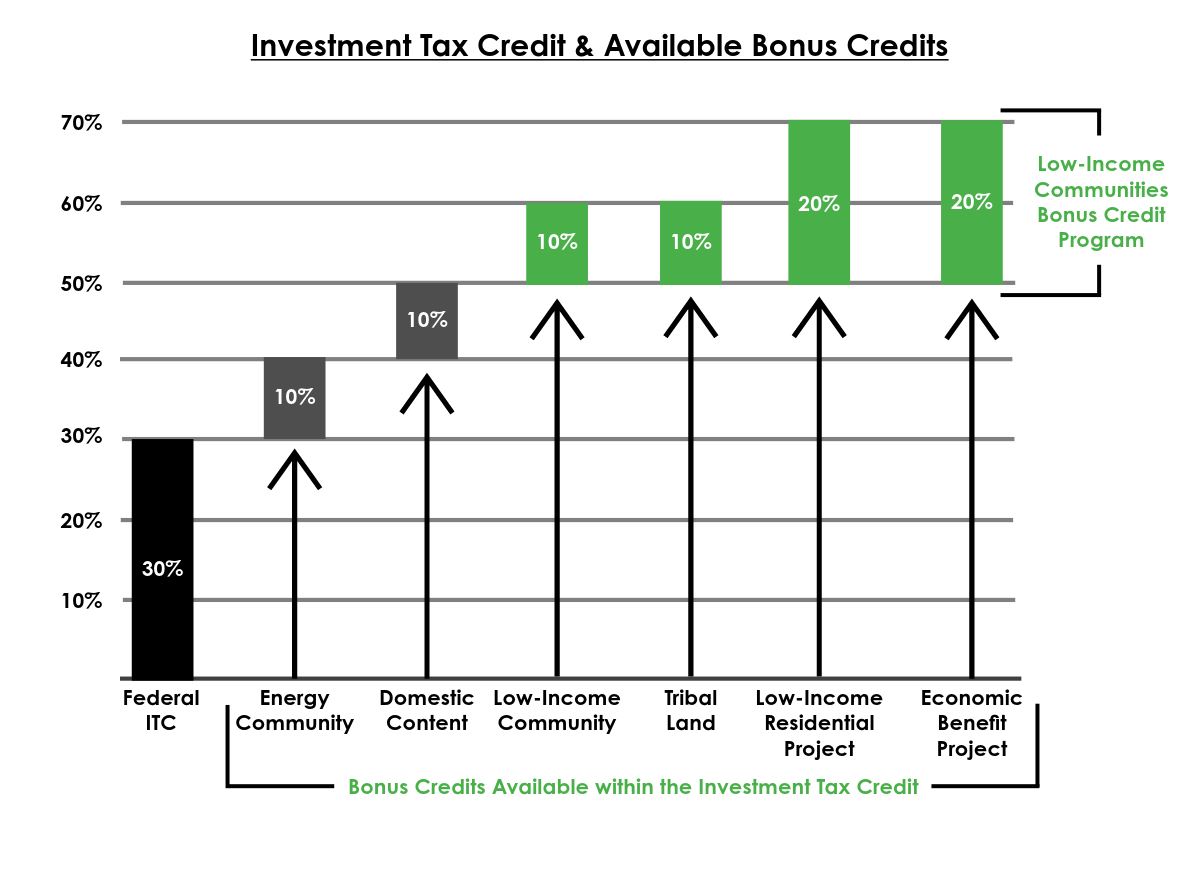

The Federal ITC can cover up to 30 percent of a project's total installation cost.

Some projects could be eligible to receive up to 70 percent of a project's cost covered by taking advantage of the following stackable bonus credits outlined in the IRA:

Low-Income Bonus

Energy Community Bonus

Domestic Content Bonus

Although the Energy Community Bonus and Domestic Content Bonus each provide an additional 10 percent, the Low-Income Communities Bonus Credit Program can add a 10 to 20 percent boost to the existing ITC.

Low-Income Bonus Credit Program

The Low-Income Bonus Credit Program supports integrating renewable energy technologies to benefit low-income households.

It does so because the program provides a substantial tax incentive on top of the ITC, and it prioritizes:

Increased adoption of and access to renewable energy facilities in underserved and environmental justice communities.

Encouraging new market participants.

Providing substantial benefits to underserved communities and individuals historically marginalized from economic opportunities and overburdened by environmental impacts.

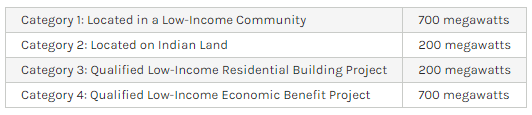

Unfortunately, not everyone can claim the program's benefits because it will allocate 1.8 GW of capacity each year for solar and wind projects.

The Department of Energy (DOE) provides a dynamic table that shows the program's remaining capacity.

Who is eligible for the program?

To be eligible, facilities must have a maximum output of less than 5 MW and fall into one of four categories that comprise the 1.8 GW Capacity Limitation.

Projects identified as categories 1 and 2 are eligible for the 10 percent tax adder, while facility categories 3 and 4 get the 20 percent tax adder.

Additional Selection Criteria

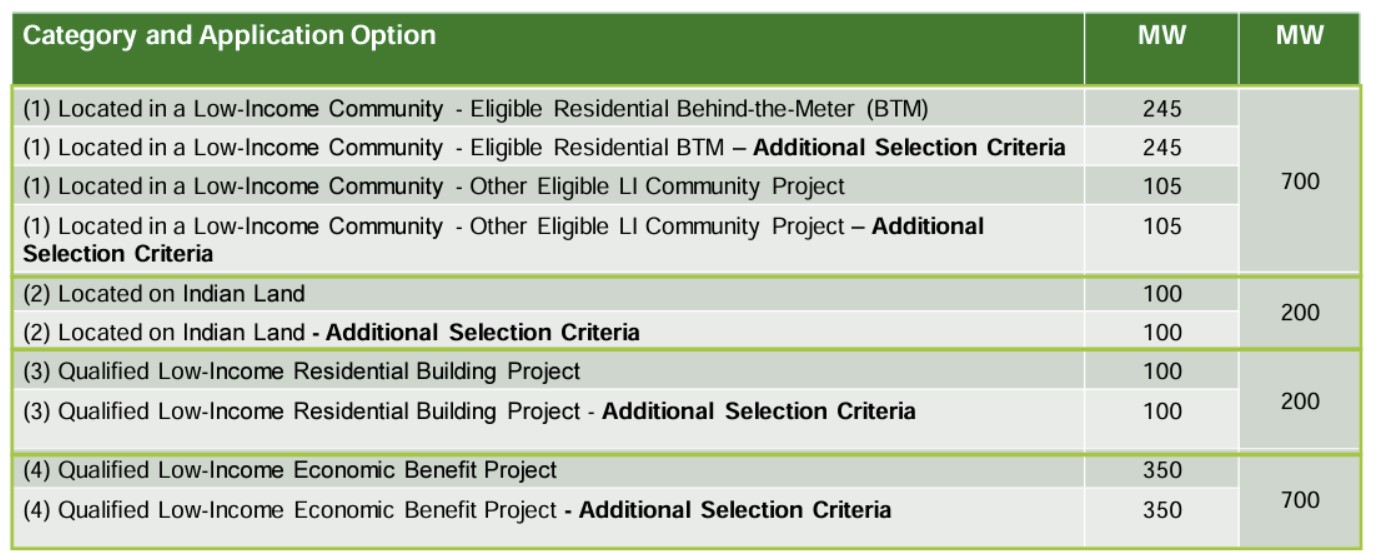

For the 2023 program year, at least 50 percent of the total capacity in each category that meets specific Additional Selection Criteria (ASC) based on ownership and geography was reserved.

Ownership

The ownership criteria are based on the applicant's characteristics: Tribal Enterprises, Alaska Native Corporations, tax-exempt entities, renewable energy cooperatives, and qualified renewable energy companies.

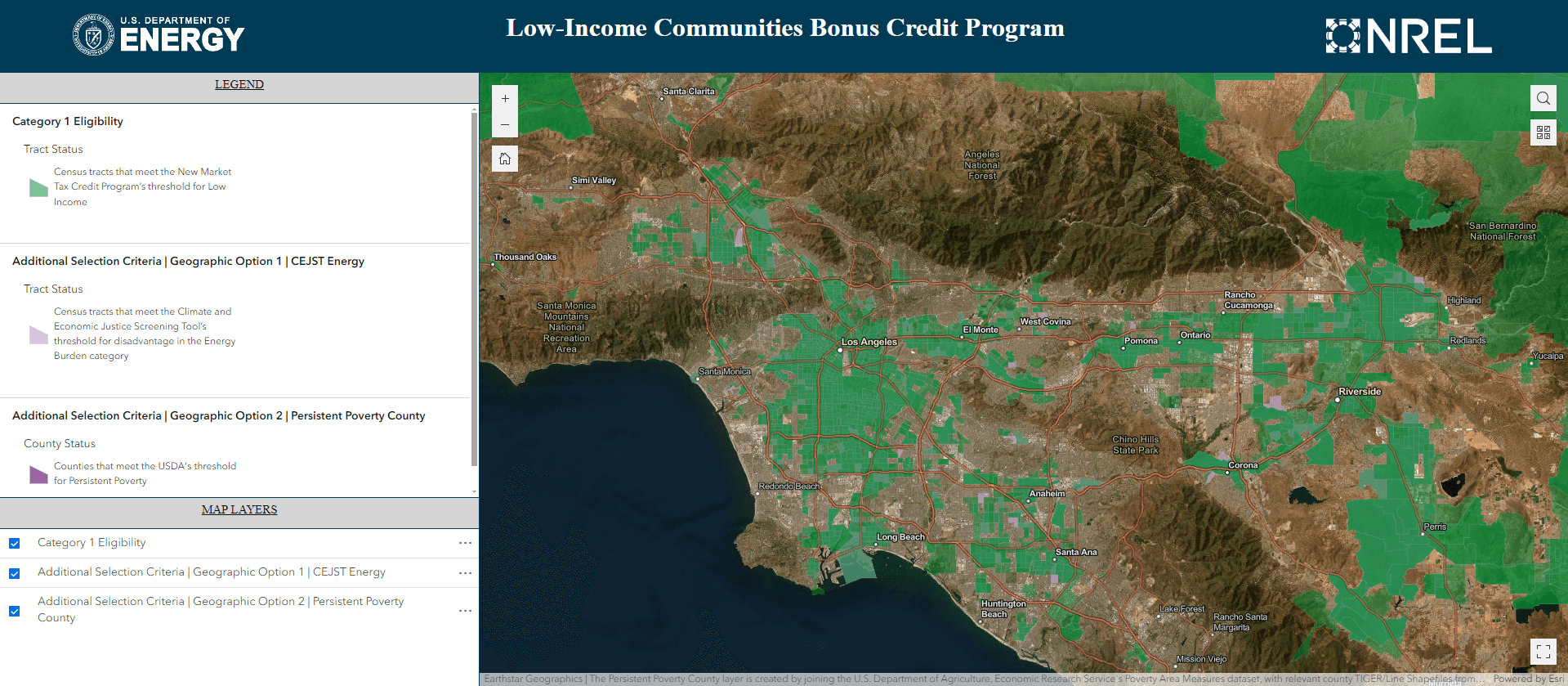

Geography

The geography criteria look at facilities located in areas with the highest burden and most minor investment. This is indicated by facilities in persistent poverty counties or areas with high energy costs determined by the Climate and Economic Justice Screening Tool.

The Application Process

When applying for the program, applicants will choose a facility category and indicate whether they meet one or more of the selection criteria.

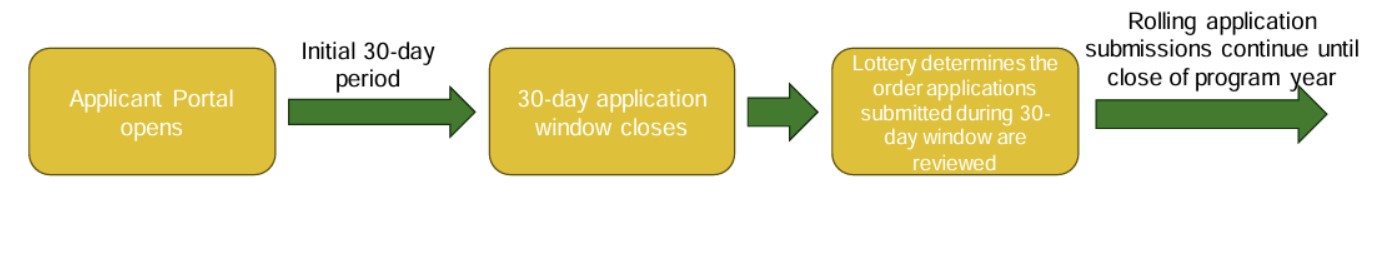

Applications can be submitted to the DOE's Applicant Portal when the program year begins—the 2023 program year opened on October 19, 2023.

In the first 30 days, applications will be treated as though they were all submitted on the same day and time.

Following the initial 30-day period, if any category sub-reservation is oversubscribed, a lottery will take place to determine the review order of the applications.

Any applications received after the initial 30 days will be added to the review queue on a rolling basis in the order they were received.

The DOE portal remains open until the end of the program year. Application submissions for 2023 closed on February 29, 2024. The Applicant Portal for 2024 is scheduled to reopen in Q2. A date will be announced in the near future.

How can Green Convergence help?

The Inflation Reduction Act continues to play a pivotal role in shaping the economics of solar and energy storage projects, and the opportunities it presents are substantial.

At Green Convergence, we are dedicated to guiding you through the complexities of these incentives, ensuring you maximize your benefits. Don't miss leveraging federal tax incentives for your renewable energy projects.

Contact us today to explore how we can navigate the landscape of incentives and contribute to the success of your sustainable energy initiatives.